Insurance for horses and their people.

Equestrian Nova Scotia is pleased to partner with Acera Insurance Services to provide excellent insurance coverages to our members. Inquiries regarding your Equestrian Nova Scotia membership's automatic or optional insurance coverage should be directed to

ACERA Insurance at 1-888-394-3330 (ask for the equine department) or [email protected]

Claims Process Information

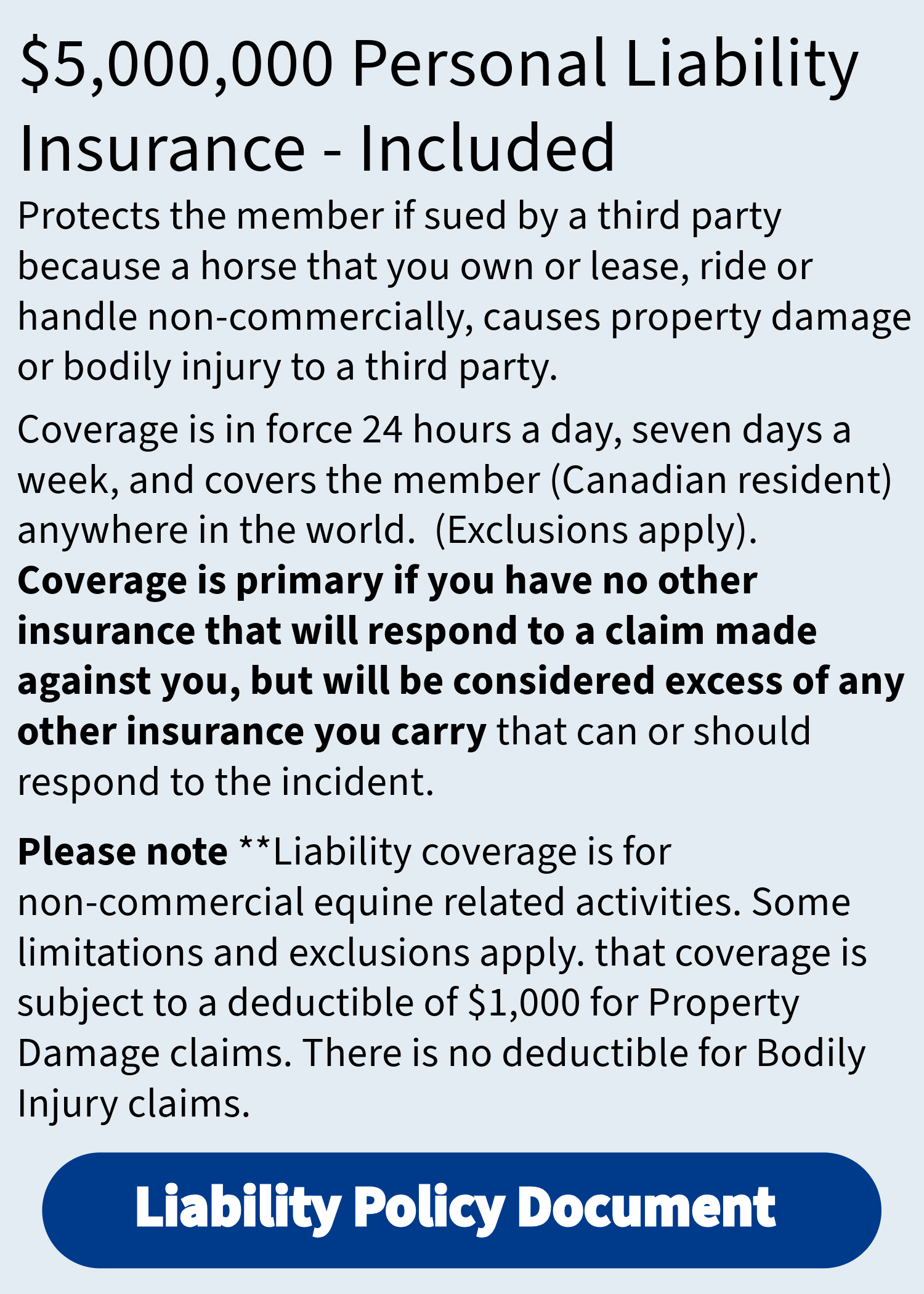

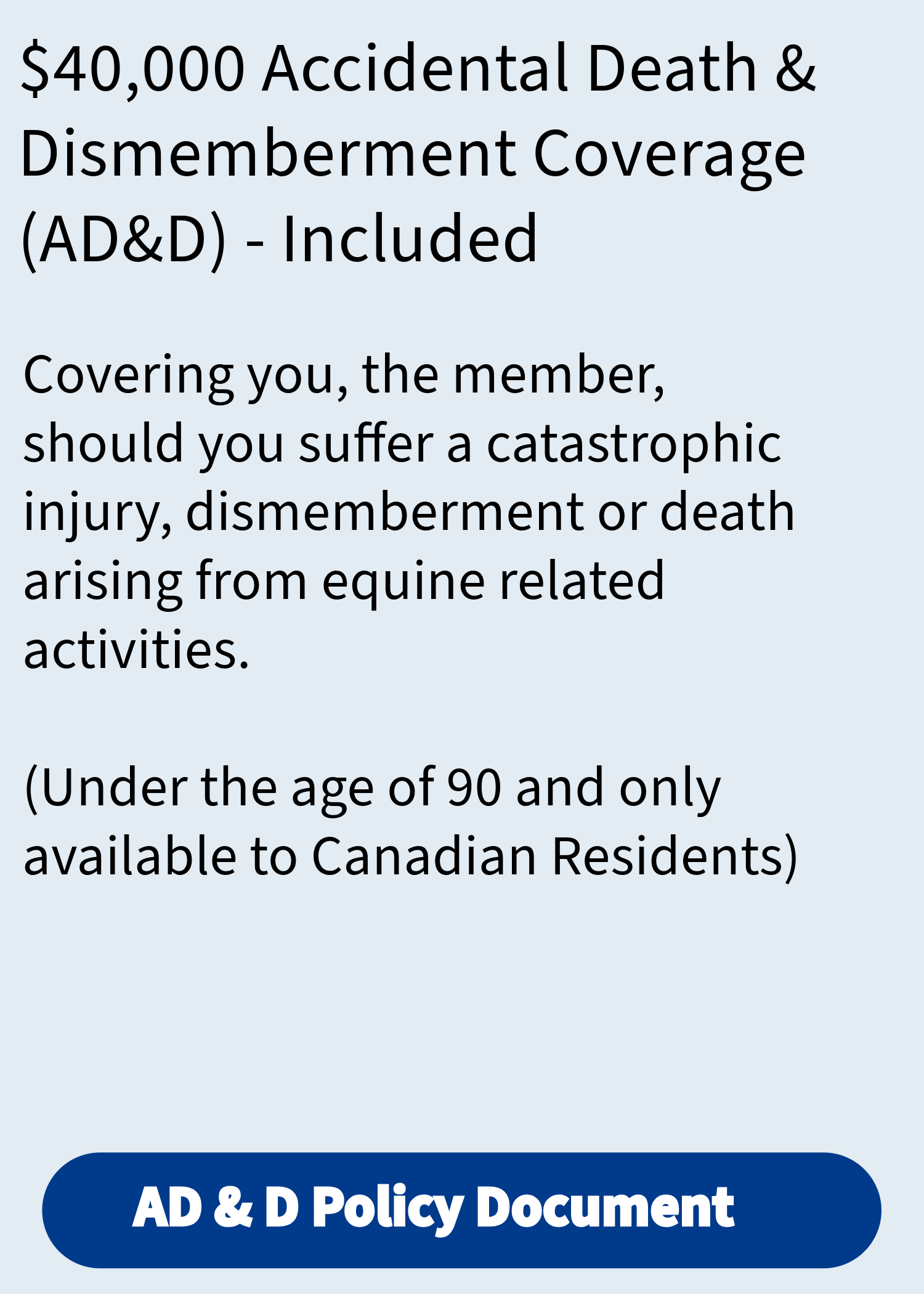

Automatic Insurance Coverage for Current Equestrian NS Members

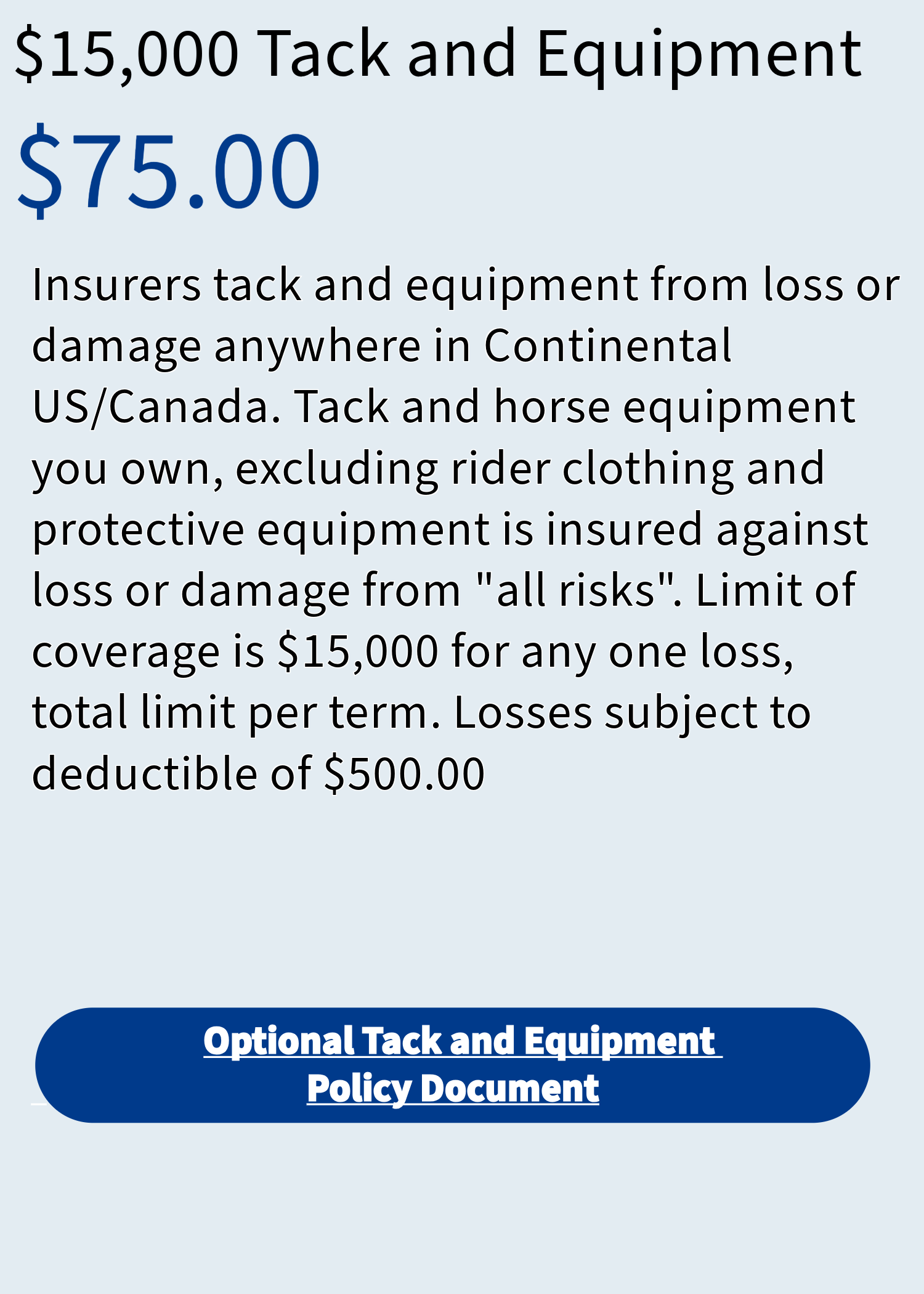

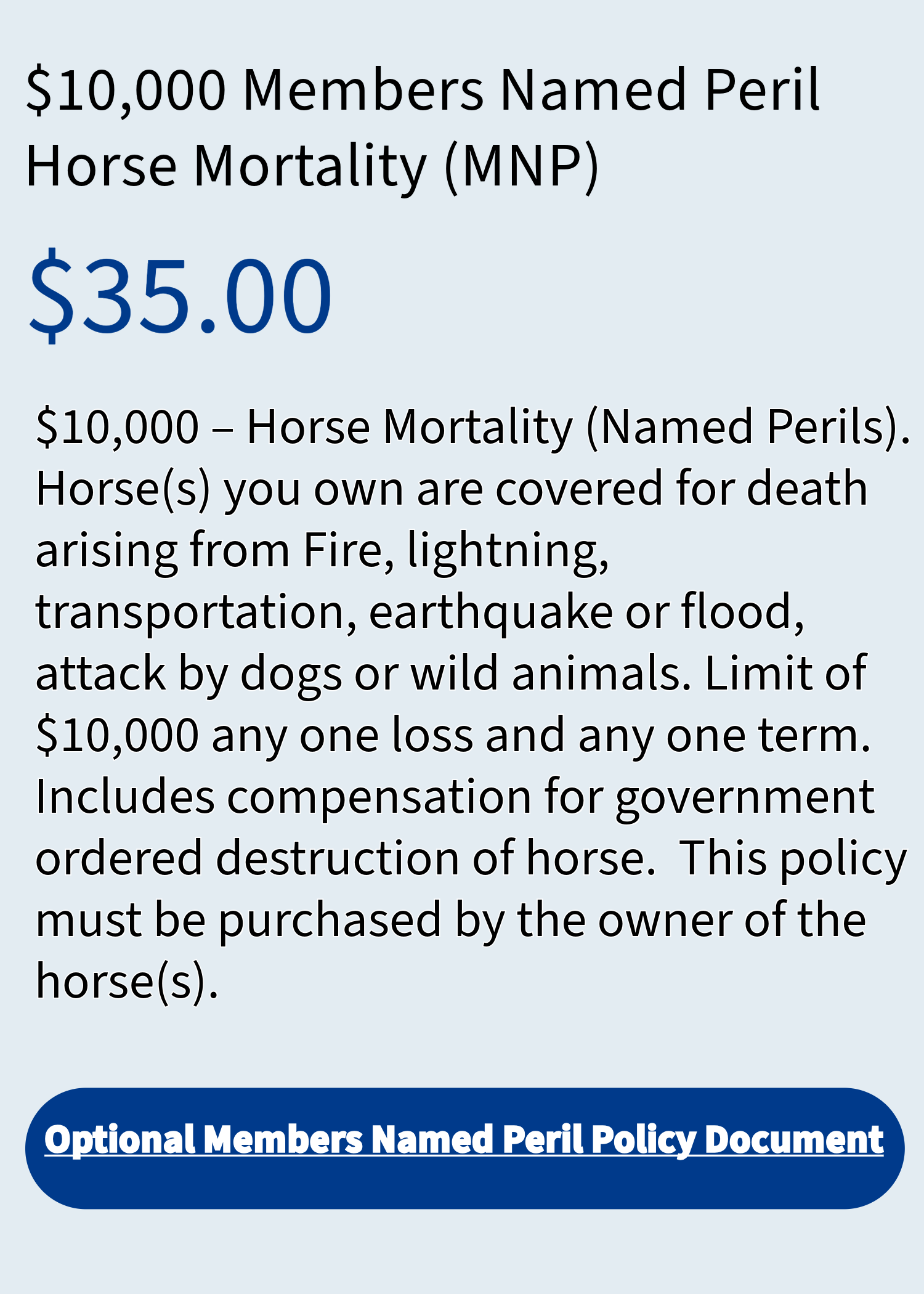

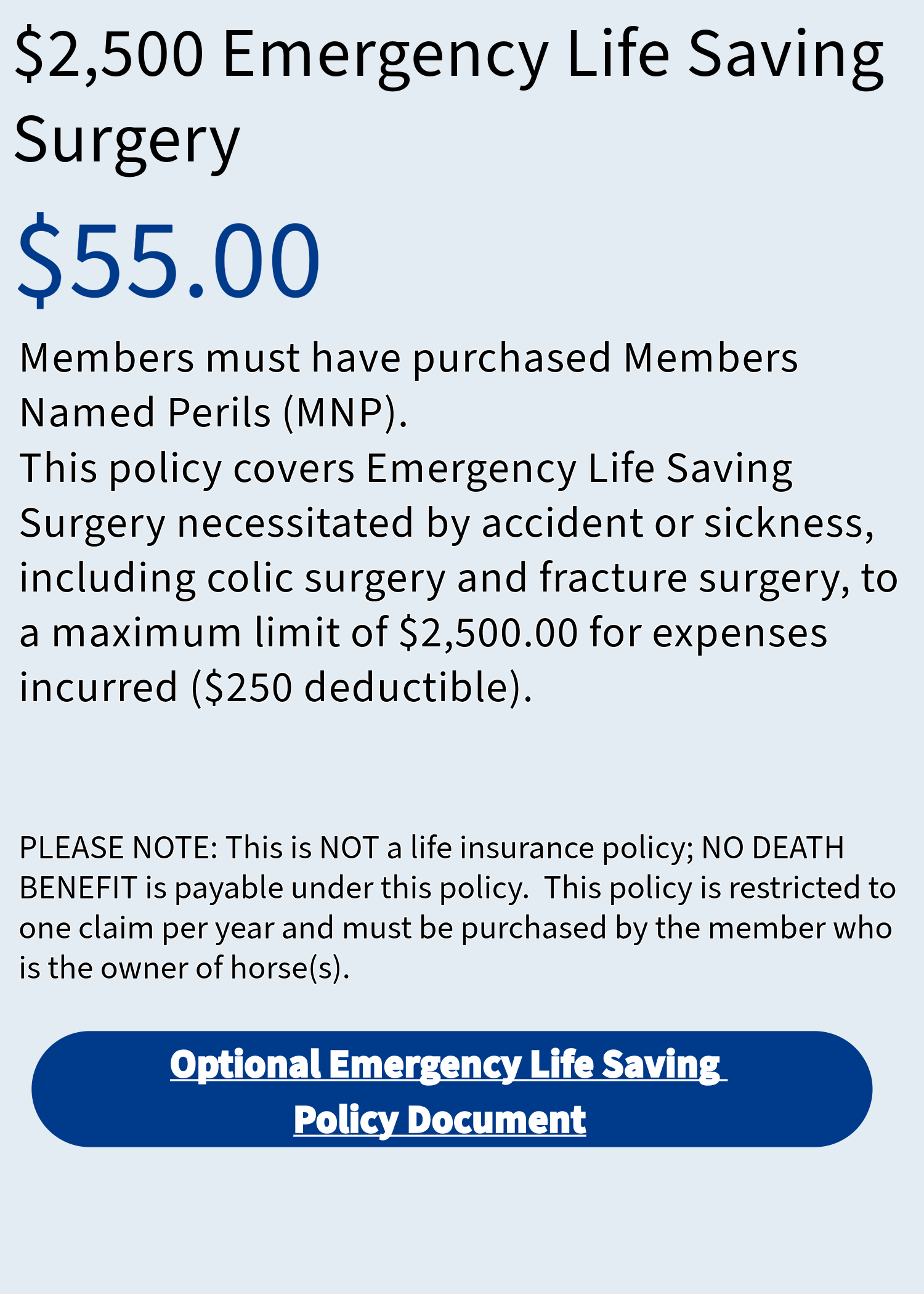

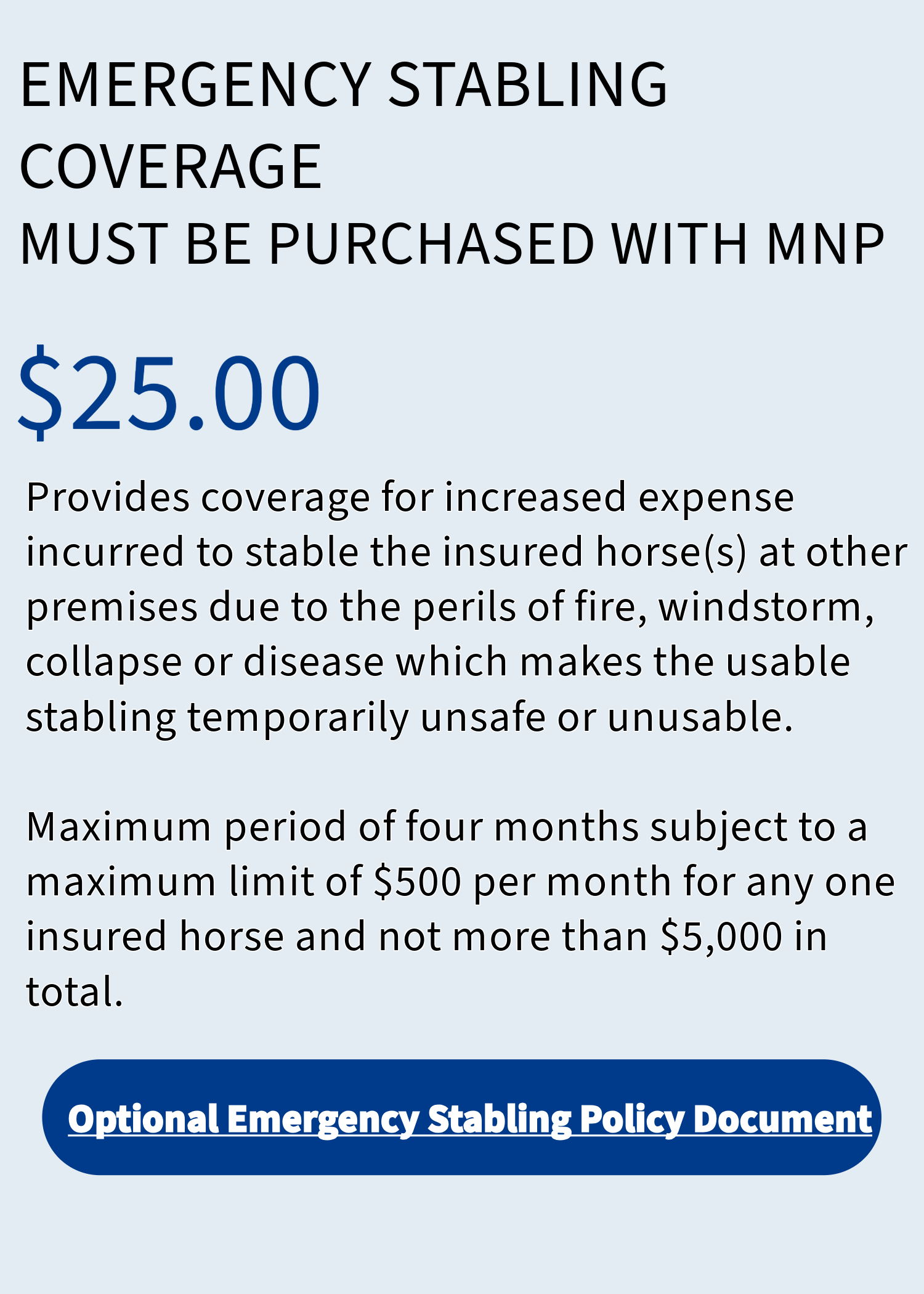

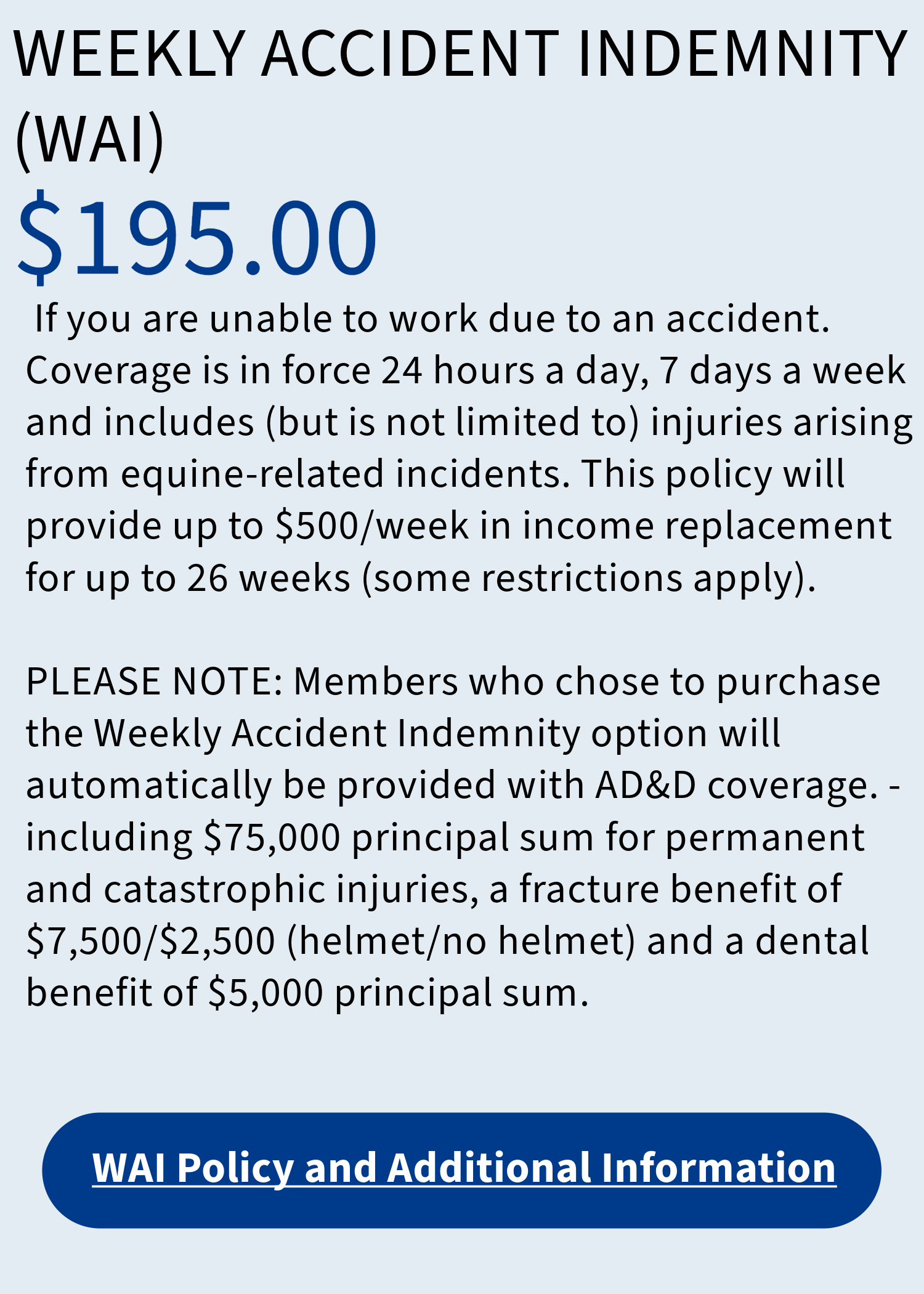

Optional Insurance Coverage

Disclaimer

The Descriptions of coverage have been prepared for information purposes only. The insuring agreements, general terms, conditions and exclusions of the actual policy will govern specific application of the various coverages referred to herein.;

The insurance coverage included and / or available as an option with your Equestrian Nova Scotia Membership is provided to you by ACERA Insurance. Equestrian NS is not licensed to sell or provide counsel on the insurance coverage. Please contact ACERA Insurance directly for any questions regarding coverage, limitations or exclusions at 1-888-394-3330 (Equine Department).